Scalping and swing trading are popular trading strategies. Both have their perks and cons. To be a successful trader, it is important to know both of these strategies and use them for personal trading needs.

Scalping is all about making quick trades, earning maximum profit from those small price movements. Being dependent on the quick market movements, scalping requires constant monitoring and quick action.

Swing trading is almost the opposite of scalping; it is about holding positions for longer periods. In this strategy, the traders focus on capturing larger price movements over days or weeks. This strategy allows for more flexibility and less frequent monitoring.

Key Takeaways

- Scalping = Rapid trades, small gains, high volume

- Swing Trading = More deliberate trades, larger gains, held for weeks/days

- Scalping requires full-time attention, rapid decision-making, and good emotional control

- Swing trading provides flexibility, reduced stress, and accommodates part-time traders

- Scalping equipment: Rapid platforms, live data, low-latency execution

- Swing equipment: Simple charting equipment, daily/weekly study

- Scalping drawbacks: High stress, increased brokerage, burnout risk

- Swing trading drawbacks: Overnight risk, need for patience

What is Scalping?

Scalping is a way to trade where the trader buys and sells stocks or other types of assets (like currency or crypto) very quickly, usually within a few minutes, for small profits. The trader is not waiting for a big price change. The trader does many trades in a day and makes little profit from every trade in a day, but this adds up over the day.

Example:

Manoj buys a stock for ₹100 and sells it in 5 minutes for ₹100.50. He has made a ₹0.50 profit. Manoj does this 20 times a day with different stocks or different price points. His total profit becomes ₹10 or more, depending on how many times he makes a trade.

What Is Swing Trading?

Swing trading is the style of trading when traders buy a stock or asset and wait a few days or weeks to capture profit on the price movement. Unlike scalpers who sell quickly, swing traders hold onto a stock or asset for a specific period, waiting for price movement to take advantage of a “swing” or possible price change against them for their profit. As price moves against them, swing traders have to wait for price to “swing” back up (or down if selling short) to take a profit.

Example:

Priya buys some shares of a stock at ₹200 and waits a few days. After a week and some price movement later, the share price had moved up to ₹230. Priya sells her stock and realized a profit of ₹30 a share. Priya doesn’t trade everyday; she only trades when she feels the opportunity is right.

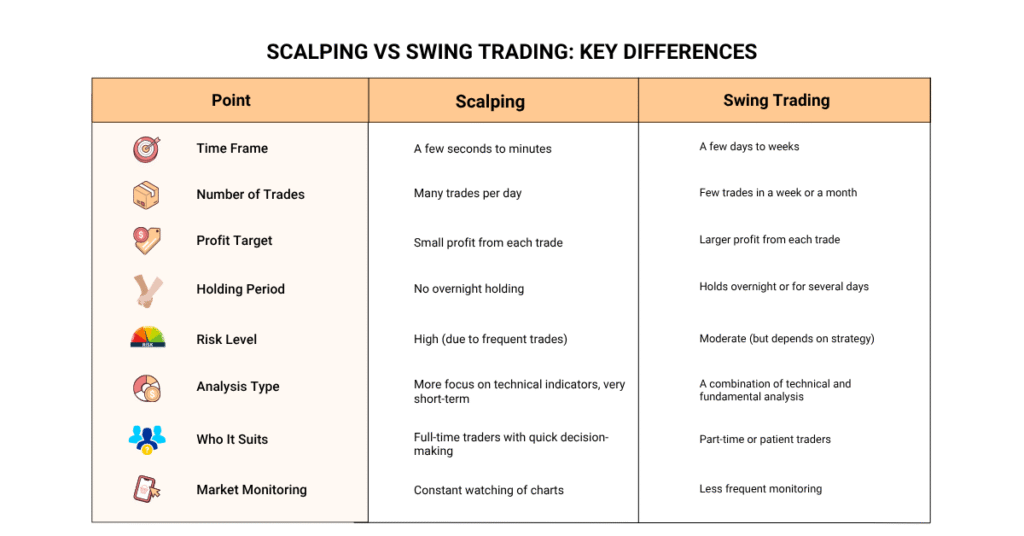

Scalping vs Swing Trading: Key Differences

Swing trading is investing styles where an investor buys a stock or another asset (or goes long) and holds it for a few days or weeks to profit from the natural price changes that happen with time. They are not like “scalpers” who sell quick items for profit. Instead, they wait for the “swing”, or the price change to move one way or another (to the upside or downwards, if shorting) and then “book” profit.

Pros and Cons of Scalping

Pros

Scalping can be a good choice for traders who enjoy quick decisions and short-term profits. It offers several benefits if done with proper skill and discipline.

Here are some Pros of scalping

- Fast profits on small price variations.

- Daily trading chances.

- Great in low-volatility (sideways) markets.

- No overnight risk as the trades are closed at the end of the day.

- Can gradually compound small equity with consistent trading.

Cons

Although scalping can produce quick profits, it has many downsides. Sure, it requires speed and focus and can be very dangerous if not done right.

Here are some Cons of scalping

- Requires full-time focus on trades and fast decision-making

- Stressful because trades take place quickly

- Lots of trades lead to more brokerage fees and taxes

- Small mistakes can lead to large losses

- Not for inexperienced traders or those with limited time

- Requires advanced charting and technical capabilities

Understanding these factors can help traders decide if scalping aligns with their financial goals and personal trading style.

Pros and Cons of Swing Trading

Pros

If you’re unable to be glued to the monitor all day, swing trading is a good alternative. Swing trading allows for more planning of trades and can be more profitable over a time-frame of a few days or weeks.

Here are some Pros of swing trading

- Less time needed compared to scalping or day trading

- More profit potential per trade

- Allows for part-time and working professionals to trade

- Less emotional pressure and more time to think trades through

- Fewer trades, so less brokerage and taxes

- Uses technical analysis and basic fundamental analysis

Cons

Swing trading may not be fast-paced, but there are still risks. Holding a trade overnight, or for days on end, leaves the trader exposed to potential news events and market gaps, leading to unwanted losses.

Here are some Cons of swing trading

- Trades are held overnight, which means you can be at risk from after-market news

- Profits take time, not a good strategy for quick profits

- Requires patience and solid discipline to wait for the right set-up

- The purpose of trading is defeated if the market reverses quickly, resulting in a hit to your stop-loss

- Not being able to catch the small price movement from scalping (prices adjusted in between trades and only holding for a small time frame)

- Requires precise entry and exit times with good analysis

Note: This can be solved by a good risk management strategy.

Scalping vs Swing Trading: Which Is More Profitable?

Both forms can be profitable. Scalping may allow for faster profits but at smaller levels, while swing trading will allow to take larger profits per trade and will be less stressful. Which option is better will depend on the trader’s skills, time, and risk aversion.

Now let’s look at their main differences:

Time Commitment and Lifestyle Considerations

The amount of time you will devote to trading is important when deciding between scalping and swing trading. One approach requires your full attention, while the other allows a flexible time perspective.

Let’s now consider both approaches using time commitment:

Scalping—Time Commitment:

Scalping demands lots of time and focus because trades are executed in seconds or minutes, so the trader must be aware and paying attention to the trades as they happen and look at the screen continuously. Because of this, scalping is only really suitable for people who can trade full time.

- Needs constant screen time

- Very fast decisions

- Not good for people with time commitments

Swing Trading – Time Commitment:

Swing trading is less busy time wise. You hold a trade for days or even weeks, so the market does not need to be check all the time. It is great for people with a job or other obligations.

Less screen time.

- Can check charts once or twice a day.

- Has much more time to plan trades calmly

- Great for part-time traders and people with jobs.

Risk, Stress, and Emotional Factors

Trading is not just a matter of strategy; trading also has an effect on your mental state and emotions. The differences in risk, pressure, and stress between scalping and swing trading are significant. Educating yourself about how each style affects your mind and your decision-making is essential when trying to determine the most suitable style.

Scalping – Risk, Stress & Emotional Factors:

- Intense pressure due to speedy decision-making

- Multiple trade chances of emotional fatigue increase

- Small mistakes can lead to fast losses

- Significant emotional discipline is required and stamina not only during trading but in between markets as well.

- Pressure to make quick decisions can create anxiousness

- Difficult, if not impossible, to remain calm during volatile markets.

Swing Trading – Risk, Stress & Emotional Factors:

- Reduce daily stress due to less frequent trading

- More time to contemplate decisions and think through positions

- The risk of news overnight or gap-downs can affect your position

- The emotional toll should be less due to the slow pace and not dealing with constant trades.

- Requires patience and emotional discipline over a long of time period of days/weeks

- Less likely to feel burned out than compared to scalping and mini-scalping.

Tools, Platforms, and Capital Requirements

Each trading style requires different tools and setups, while both scalping and swing trading will require a trader to have access to trading platforms, there is often quite a variation in speed, features and capital needed. Understanding the elements of each style will help you choose appropriate setups and allocate budgets.

Scalping – Tools, Platforms & Capital Needs:

- Needs a speedy and dependable trading platform with real-time quotes

- Must have sufficient bandwidth to eliminate delayed quotes

- Tends to use advanced charting tools with technical indicators

- Can trade with less capital but needs higher volume – a trader does not get rich by using enormous capital

- The brokerage fees can add up quickly, as you will be placing many trades

- Nice to have low-latency order execution available?

Swing Trading – Tools, Platforms & Capital Needs:

- Can function with conventional trading platforms; real-time speed is not as important

- A regular internet speed will usually suffice

- Uses technical analysis and sometimes basic fundamental analysis

- Fewer trades mean a lower impact from brokerage commissions

- Can begin with moderate capital without requiring high frequency

How to Choose the Right Strategy for You

Deciding between scalping and swing trading ultimately depends on your lifestyle, personality, and goals. There’s no perfect strategy; what’s best is what works best for you.

You need to ask yourself the following questions:

How much time can I dedicate to trading each day?

If trading is a full-time commitment, then scalping may be suitable. Otherwise, if your life is busy, swing trading is a better option then.

Do I handle stress well?

Scalping is very stressful and focused on fast responding. If you prefer a calmer pace, then swing trading is a better option for you.

Do I like to make quick decisions, or do I prefer to plan first?

Scalpers have to act quickly, and rapid decisions are essential. Swing traders may deliberate and take their time.

What are my target profits and risk tolerance?

If you are comfortable taking small, quick profits and frequent trading, you should give scalping a try. If you are looking for larger, slower profits and comfortable with holding positions over the longer term, try swing trading.

How much capital do I have at my disposal?

Scalping may require more of the capital you can actively dedicate to a position since it requires volume trading. Swing trading alternatively may have a slower capital growth since swings trades are only erected every few days or weeks.

Frequently Asked Questions: Scalping vs Swing Trading

It all depends on your time, your skill level, and your tolerance for stress. Swing trading is best for a part time trader; scalping is best for a full time trader that can make quick decisions.

Scalping is a form of day trading but much faster. I would only say that scalping is better if you can handle that kind of speed, pressure, and if you can make high speed decisions consistently.

Yes, but only if you have serious discipline, great execution and a solid strategy. Scalping has low profit margins, which means consistency is your number one focus.

Popular strategies include using a 1-minute chart with moving averages, RSI + price action, or scalping breakouts based on support/resistance.

Swing trading is generally better. It is much slower, easier to learn, and less stressful than other types of trading.

- Your risk of overnight news affecting pricing.

- Requires more patience and discipline.

- You will make slower returns than intraday trading.

- You will have positions open for longer periods that tie up your account capital.

Conclusion: Finding Your Trading Edge

Deciding whether you want to be a scalper or swing trader depends on several factors that ultimately depend on your time available and risk tolerance. Each strategy offers different benefits and challenges, and understanding the differences can help you decide what fits your goals as a trader. In the end, your success relies upon adapting the strategy that aligns with your lifestyle and trading style. Find the strategy that gives you confidence and maximises your strengths.

I hope you made it to the last part of this blog!, and learnt more about swing trading vs scalping If you did, congratulations! You should keep yourself informed if you want to succeed with money. Learning more about the stock market, mutual funds, trading and finance can be done by following our blog, StofinIQ. Doing this will teach you important things that support you in making smart financial choices.

Reference:

I left my engineering job to follow my true passion writing and research. A passionate explorer of words and knowledge, I find joy in diving deep into topics and turning rich, insightful research into compelling, impactful content. Whether it’s storytelling, technical writing, or brand narratives, I believe that the right words can make a real difference.

F*ckin’ awesome issues here. I am very glad to peer your article. Thank you a lot and i’m having a look ahead to touch you. Will you kindly drop me a e-mail?

Undeniably believe that which you stated. Your favorite justification appeared to be on the net the simplest thing to be aware of. I say to you, I definitely get irked while people consider worries that they just do not know about. You managed to hit the nail upon the top and also defined out the whole thing without having side-effects , people could take a signal. Will likely be back to get more. Thanks