Volatility is a trader’s best friend—or worst enemy—depending on how well they manage it. If you know how to harness volatility, you can make substantial profits even in unpredictable markets. This guide will cover the best strategies for trading volatility, helping you navigate turbulent times with confidence.

What is Volatility in Trading?

Understanding Market Volatility

Volatility indicates how much trading prices change over a period. A market with high volatility sees quick and significant price shifts, while a low-volatility market shows more gradual price changes.

Why Volatility Matters for Traders

- Provides opportunities for higher returns

- Increases risk exposure

- Requires careful risk management

Key Indicators for Measuring Volatility

1. The VIX (Volatility Index)

The VIX, often termed the “fear gauge,” evaluates market sentiment and projects expected volatility in the S&P 500.

2. Bollinger Bands

These bands expand and contract based on market volatility, helping traders spot breakouts.

3. Average True Range (ATR)

ATR helps assess the level of volatility by calculating the average movement of an asset over a given period.

4. Moving Averages

Short- and long-term moving averages help identify trends and potential volatility shifts.

Best Strategies for Trading Volatility

1. The Straddle Strategy

This options trading strategy involves buying both a call and a put option at the same strike price and expiration date, allowing traders to profit from large price movements in either direction.

2. The Strangle Strategy

Similar to the straddle, but the call and put options have different strike prices. This strategy is cheaper than a straddle but requires greater price movement to be profitable.

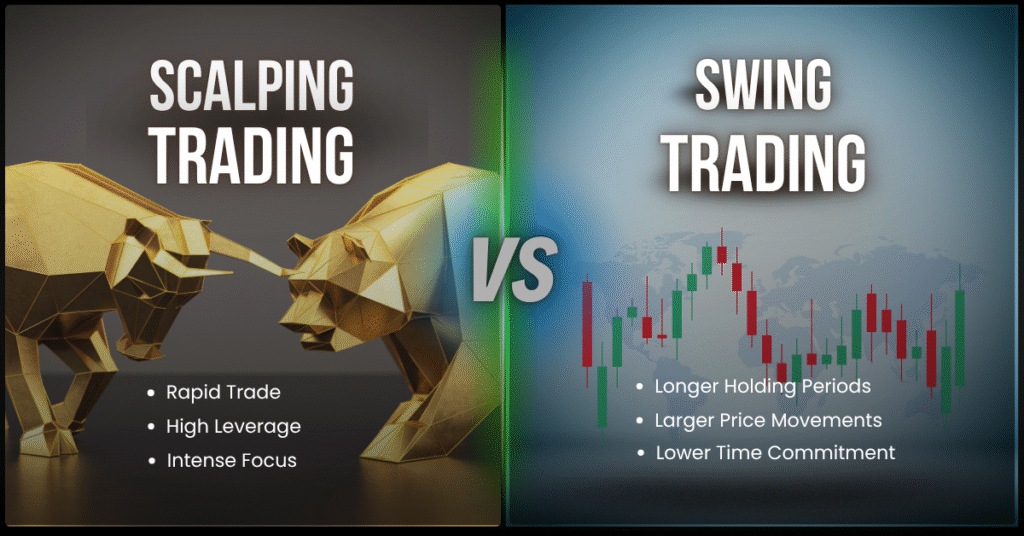

3. Swing Trading

Swing traders capitalize on short-term price swings by entering trades when volatility spikes and exiting before the momentum fades.

4. Scalping

A high-frequency strategy where traders make quick profits from small price movements in highly volatile markets.

5. Breakout Trading

This strategy involves entering a trade when the price breaks through a key level of support or resistance, often following a period of low volatility.

6. Mean Reversion Strategy

Traders using this strategy assume that prices will revert to their average over time, taking positions when an asset is overbought or oversold.

7. Hedging with Options

Traders use options to protect their portfolios against excessive losses in volatile markets.

8. Trading the News

Market-moving news often leads to increased volatility, providing trading opportunities for those who react quickly.

9. Risk Reversal Strategy

This advanced options strategy involves selling a put option and buying a call option, often used when expecting significant upward movement.

10. Pairs Trading

Pairs trading involves taking opposite positions in two highly correlated assets, profiting from relative price movements rather than overall market direction.

Risk Management in Volatile Markets

1. Set Stop-Loss Orders

Predefined stop-loss levels help limit potential losses in case of an unexpected market move.

2. Position Sizing

Keeping positions small relative to portfolio size helps mitigate risks in highly volatile conditions.

3. Diversification

Holding a mix of assets reduces exposure to excessive volatility in a single market or asset.

4. Avoid Overleveraging

Using excessive leverage in volatile markets can wipe out accounts quickly, making conservative leverage use essential.

5. Keep an Eye on Economic Events

Major announcements like interest rate decisions and employment reports can trigger sharp volatility spikes.

Psychological Aspects of Trading Volatility

1. Control Your Emotions

Emotions like fear and greed can obscure our judgment, causing us to make hasty decisions.

2. Stick to Your Plan

Develop a clear trading plan and follow it rigorously, even in the face of rapid price changes.

3. Take Breaks

Trading in high-volatility markets can be exhausting. Taking breaks helps maintain focus and discipline.

Conclusion

Volatility in trading can lead to significant profits, but it requires a combination of skill, discipline, and a strong risk management approach. By familiarizing themselves with important volatility indicators and applying effective strategies like straddles, swing trading, and hedging, traders can benefit from market changes while reducing their risks.

FAQs

1. Is trading volatility risky?

Yes, high volatility can lead to large gains but also significant losses. Proper risk management is crucial.

2. What is the best strategy for beginner traders?

Swing trading and breakout trading are simpler strategies that beginners can use to navigate volatile markets.

3. How can I predict market volatility?

Using indicators like the VIX, Bollinger Bands, and ATR can help predict and measure market volatility.

4. Can I trade volatility without options?

Yes, traders can use strategies like breakout trading and scalping without involving options.

5. What is the safest way to trade volatility?

The safest approach is using hedging strategies, keeping position sizes small, and setting strict stop-loss levels.