Mark Douglas isn’t remembered for making bold market predictions or managing a billion-dollar hedge fund—he’s remembered for something far more difficult: changing the way traders think. Born in 1948 in the United States, Douglas dedicated much of his life to understanding the psychological side of trading. He was married to fellow trading educator Paula T. Webb. Long before trading psychology became a buzzword, Douglas was asking the uncomfortable question:

Why do skilled traders fail? What role do fear, overconfidence, and uncertainty play in consistent losses? And how can someone actually train their mind to handle the chaos of the markets? His groundbreaking work challenged traders to look inward, making mindset as essential as strategy.

His books—especially Trading in the Zone—became essential reading for anyone serious about trading. But while his ideas continue to guide thousands, one question keeps coming up: was Mark Douglas himself a successful trader? Did he walk the talk, or was his real strength in observation and teaching? In this article, we’ll break down Douglas’s career, explore his most influential work, and look at what we know about his net worth, legacy, and the truth behind his own trading journey.

Who was Mark Douglas?

No Mark Douglas didn’t come from a Wall Street background. He wasn’t a hedge fund superstar or a media personality making loud calls on financial news. What set him apart was his ability to notice a silent pattern—talented traders who kept failing not because of poor strategies, but because of mental roadblocks they couldn’t name.

Douglas entered the trading world in the late 1970s and quickly realized that most of the problems traders faced had little to do with charts or market analysis. The real challenge was internal—fear, hesitation, impulsiveness, and the need to be right. These patterns repeated no matter the market or the method. After a series of personal trading struggles, he began to study his own behaviour and that of other traders around him.

This curiosity eventually turned into a career. Douglas started working as a coach and consultant, helping traders understand the mental side of trading. He worked with brokerage firms, trading desks, and private clients. Unlike many authors, he wasn’t speaking from a pedestal. He had made the same mistakes, felt the same frustration, and had slowly built a framework to understand why.

His ability to explain psychological concepts in practical terms made his work stand out. He wasn’t offering empty motivation. He was showing traders how to rebuild their mindset from the ground up. That approach became the foundation for everything he later published—and the reason his name still comes up in trading circles today.

like many who tried their hand at the markets, he faced losses early on. But instead of looking for better strategies or indicators, he started paying close attention to his own behaviour—how emotions, expectations, and hesitation were interfering with his decisions.

This self-inquiry slowly turned into a career. Douglas began consulting for traders, then for firms, helping them understand the mental traps that repeated themselves regardless of skill level or market conditions. Over time, he developed a structured way to explain what was going wrong and how to correct it—not through tactics, but through mindset.

He wasn’t offering motivational fluff. His focus was clarity: understanding risk, staying neutral to outcomes, and learning to execute without emotional interference. What he taught would later be called trading psychology, long before it became a trend.

Mark Douglas's Net Worth and Career Highlights

There are no official documents that can accurately indicate the net worth of Mark Douglas and that is not a surprise. He did not make himself famous upon some brilliant achievement or demonstration of wealth. The value of what he provided was long-term- the changing of the ways people viewed the markets through ideas.

Books Royalties, Seminars, Private Coaching and Corporate consulting were probably his primary sources of income. Even after his death, he still sells his books, most notably Trading in the Zone, years after his death which is an indicator of how he has cemented himself in the trading world. He also published video training and even conducted live workshops, most of which were taken up by trading firms to train recruits.

Douglas represented retail individual traders as well as professionals. The fact that he could address both groups and not alter the essence of the message was an attractive feature as well. The scenario could be that someone was dealing with his small account or a trade with a team in a firm but the difficulties that he resolved were the same; the hesitation, fear, impulsiveness, and overconfidence.

He was not a name in the conventional sense of the word in the world of investment, nevertheless, his name was not a lightweight in the world of traders. Traders who had never read most market theorists had at least heard of Mark Douglas–and indeed they had attributed to him their eventual success in being consistent.

Mark Douglas Books

Mark Douglas’s books are regarded as a must-read for anyone who is on the serious path of knowing how to deal with the mental components of trading. He did not work with technical indicators and strategies. No, he studied the reason why so many traders lose, even with the best tools, and why the frame of mind is an X factor in the success of the longer duration.

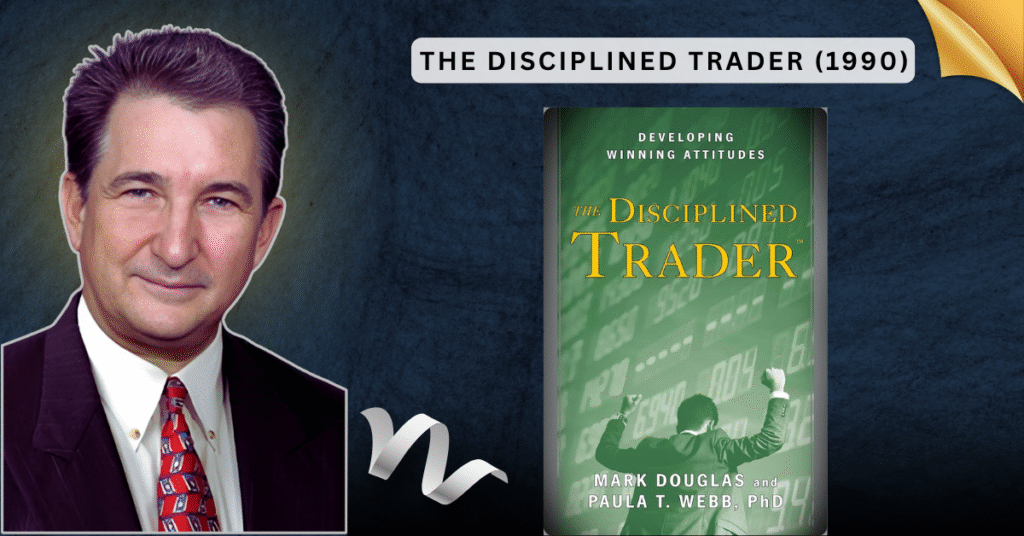

1. The Disciplined Trader (1990)

One of the earliest books to take trading psychology seriously as an independent science was the 1990 book The Disciplined Trader by Mark Douglas. It touched on the dilemma of the human struggle of having money, risk and being uncertain. Douglas proposed concepts that did not prevail then: how sellers turn out to perfectionally undermine themselves, how to build the fear of being mistaken and end up with indecisiveness, and why being disciplined matters more than being right.

This book was the start of a complete movement in the psychology of trading. Although it is more technical in terms of its language than his later writing it is, nevertheless, regarded as being one of the best books to read that can help traders to create their own patterns.

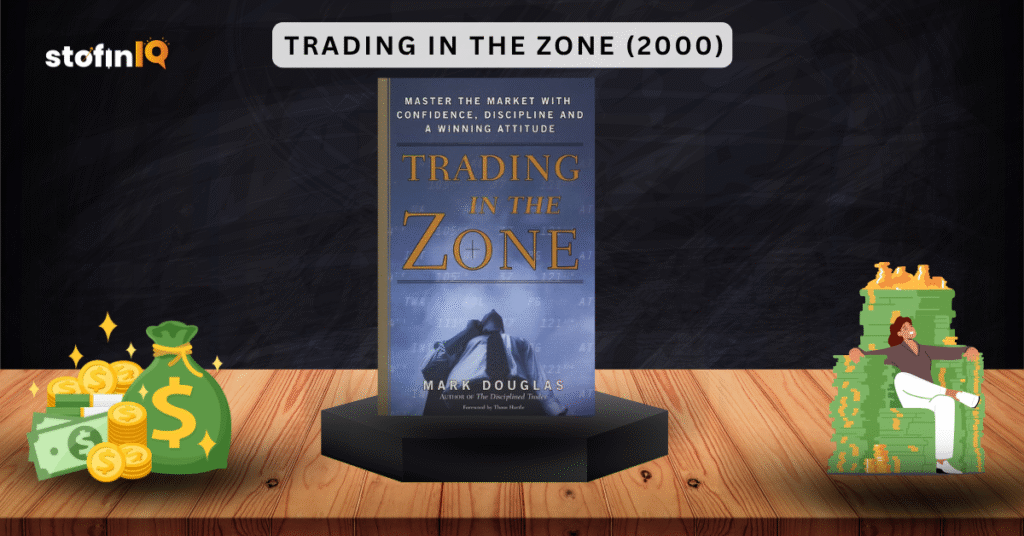

2. Trading in the Zone (2000)

Probably you heard about Mark Douglas but it is most likely due to this book. The book Trading in the Zone is considered one of the finest books on trading psychology ever written. It is a basic read when working at many proprietary trading companies and trading coaches.

Douglas, in plain commonsense language, tells why traders need to reason probabilistically and dissociate themselves emotionally with the consequences of a particular trade. Among the most popular lessons of the book, we can mention the following one: consistency does not lie in forecasting the market; it lies in sticking to your system and keeping your responses under control.

This is not a book only for beginners. Even traders of high experience read it again to recondition their way of thinking and bring up the essential values. If you’re looking for a Trading in the Zone summary, the key themes include:

- Probability In place of certainty

- Taking full responsibility for a risk before engaging in a trade

- Being meant to lose the right to be right

- Neutrality, no matter what the outcome of the trade is.

3. Training, Seminars and Legacy Materials

In addition to his two big books, Mark Douglas developed seminars, video courses and also trading psychology classes. These live sessions exposed the traders directly to his methods and most of the recordings are still today being shared over forums and trading communities.

His teachings are still taught on through mentorships, trading academies and personal trader development programs. Much of what you learn today as trading mindset, be it on YouTube or taught by institutions, can be traced to ideas Douglas came up with.

Trading Psychology According to Mark Douglas

When traders discuss how to control their emotions, what they end up repeating are platitudes that lack any depth such as being calm, avoid overtrading, and risk management. However, Mark Douglas was more thorough. He provided a complete path of what it really means to think the way a professional trader does. The principles of trading psychology was not merely tips. They were psychological dispositions to enable traders to cope with that uncertainty in the market.

At the heart of his work was this idea: you can’t control the market, but you can control how you respond to it. It is that shift (or shift in thinking) that made his approach stand out.

Key Concepts of Mark Douglas’ Mindset Approach

1. Probability Thinking

Douglas said that one of the most important lessons in learning how to treat every trade is that it is only one of the events in a bigger series. He equated trading to professional poker playing. There is no requirement to have a winning hand, you just have to play the hands so that you can have an overall win in the long run. Such an attitude assists traders when they are losing their money and not overestimate themselves by winning.

2. Trading Trade Emotion

Douglas proposed to embrace fear instead of struggling against it. Fear, greed and doubt will present themselves and that is when it counts how you go about it despite your feelings. His work demonstrated the way traders could develop emotional discipline not by imposing will power, but by altering their ways of thinking.

3. Total Risk Acceptance

Douglas says that trading without accepting the risk is half-way like driving without brakes. As long as you are still wishing you would not lose, you are either hesitating, quitting too quickly or panicking at the worst possible time. He imbibed that losing is not only an understanding, that emancipates the mind to make better, more objective decisions.

4. Psychological Detachment

Most traders have an emotional attachment to the outcome of their one trade: either it may win or lose. To Douglas, this was a snare. The real confidence in trading does not lie in the outcomes of a trade, but in the confidence of the process followed. As soon as you realize that one trade does not matter in the long term, you cease to pursue or avoid results.

The Reason This Approach is Relevant nowadays

Most of the trading blunders that people encounter today especially in retail trading still boil down to lack of proper psychology and not strategies. Overtrading, revenge trading, fear of missing out (FOMO), and holding losses too long all stem from the same root: unmanaged emotional responses.

Douglas’s teachings remain highly relevant in today’s fast-moving, emotionally-charged markets. No matter whether you are day trading crypto or swinging stocks, his investing psychology still fits.

If you’re looking for a way to stop second-guessing yourself, overreacting to losses, or blowing up your account after a string of wins, the principles laid out by Mark Douglas on trading psychology are still some of the most effective ever written.

Was Mark Douglas a Good Trader?

This is the question many traders ask after reading his work: Was Mark Douglas a good trader himself? It’s fair to wonder, especially when someone becomes famous for teaching a subject as personal and results-driven as trading.

The short answer? Douglas was not known for being a consistently profitable trader over a long period, at least not publicly. Unlike fund managers or professional traders who post returns or manage capital, Douglas didn’t leave behind a track record of trades or portfolio performance. He didn’t publish performance metrics, and there are no interviews or records showing specific trades or P&L numbers.

That said, he did trade. Early in his career, Douglas took positions in the markets and experienced the same emotional swings that most beginners go through. His own struggles with inconsistency and self-sabotage were what pushed him to explore the mental side of trading in the first place. In many ways, his value came from his ability to observe and decode those patterns—not necessarily from beating the market himself.

For some, that raises doubts. After all, why take advice from someone who didn’t “make it big” in the markets? But here’s where context matters.

Experience vs. Insight

Douglas wasn’t pretending to be a market wizard. He positioned himself as someone who deeply studied how traders think, behave, and evolve. His role was closer to that of a performance coach or behavioural analyst than a technical expert.

Plenty of elite athletes have been coached by people who never competed at the same level. In the same way, Mark Douglas’s strength lay in simplifying how the mind reacts to uncertainty, risk, and loss—and offering practical tools to manage it.

His clients, including institutional traders and prop firms, often praised the real-world results of his coaching. Many credit his ideas with helping them finally move from emotional, inconsistent trading to stable, rule-based execution. That influence speaks for itself.

So, Was He a “Good” Trader?

If “good trader” means someone who pulls in massive profits and publishes their win rate, no, Mark Douglas doesn’t fit that profile. But if it means someone who understood the game, faced it head-on, learned from their failures, and taught thousands how to stop blowing up their accounts—then yes, in that sense, he was one of the most valuable traders the industry has ever seen.

Congratulations on finishing the blog!

If you enjoyed this story, you’re in for a treat. At StofinIQ, we want to help you be knowledgeable, relatable, and empowered when it comes to finance and investing. Whether that is examining mutual funds, looking through stock market trends, or various storytelling that connects a personal journey with a financial lesson, we hope to truly be your go-to source.

I left my engineering job to follow my true passion writing and research. A passionate explorer of words and knowledge, I find joy in diving deep into topics and turning rich, insightful research into compelling, impactful content. Whether it’s storytelling, technical writing, or brand narratives, I believe that the right words can make a real difference.