What Are Harmonic Patterns?

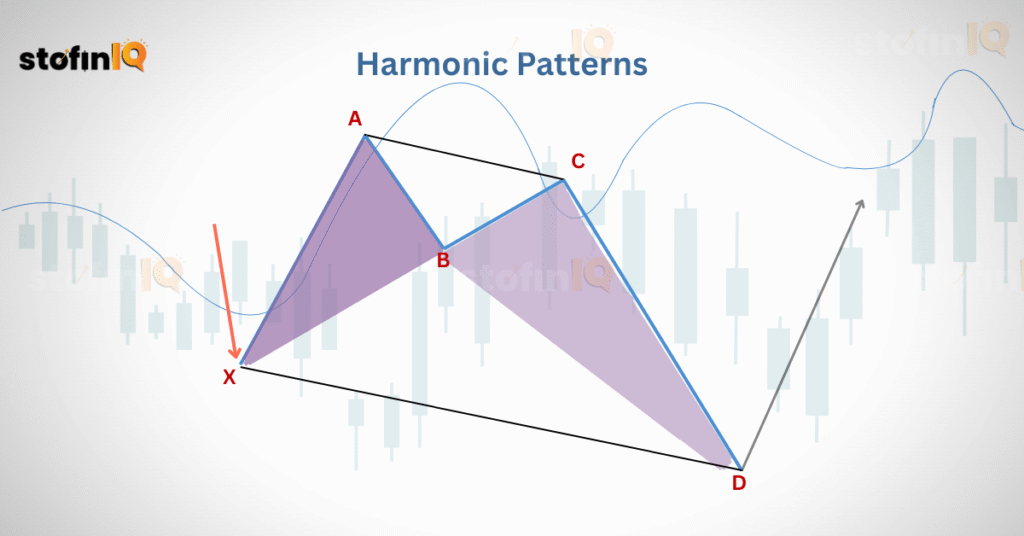

Harmonic patterns are special trading shapes that help traders predict when the market might change its direction. Here the patterns of Finonacci ratios are used. Harmonic patterns are not like regular patterns, but they focus on precise measurement and symmetry.

These patterns are made up of five important points: X, A, B, C and D.

These shapes create different shapes like the Gartley, Bat, Butterfly and Crab. Each of these shapes follows specific Fibonacci levels that traders usually look forward to.

The main purpose of these patterns is to find points in the market where it is likely to reverse, this gives the traders a chance to reverse or to exit their trades at the right time. For beginners, the harmonic patterns cheat sheet is really helpful as it can summarize the different types of shapes and Fibonacci numbers needed for each pattern.

Key Takeaways

- Harmonic patterns are based on the principle that price movements in financial markets usually follow specific geometric structures and Fibonacci ratios.

- Harmonic patterns can help traders in analysis, giving them insights into trend reversals and trend continuations.

- There are 7 most common harmonic patterns.

- The complexity of the harmonic patterns serves as a disadvantage of these patterns.

What is the Role of Fibonacci in Harmonic Patterns?

Fibonacci ratios are the backbone of harmonic patterns. These ratios are derived from the Fibonacci sequence, and they play a crucial role in defining the length and position of each leg in the pattern.

Commonly used ratios include 0.618, 0.786, 1.272, and 1.618, which determine how far each swing in the price should move. For example, in the Bat pattern, the retracement of the AB leg typically ends near the 0.382 or 0.50 level, while the CD leg is often an extension to 1.618.

These mathematical rules help confirm the validity of the pattern and improve the trader’s confidence in placing trades. A harmonic patterns cheat sheet outlines all these ratios for easy reference, making it an indispensable tool when analyzing charts.

Types of harmonic patterns:

Let’s dive into the most recognized types of harmonic patterns, each with its own unique geometry and significance. Keep this harmonic patterns cheat sheet handy as we go through them.

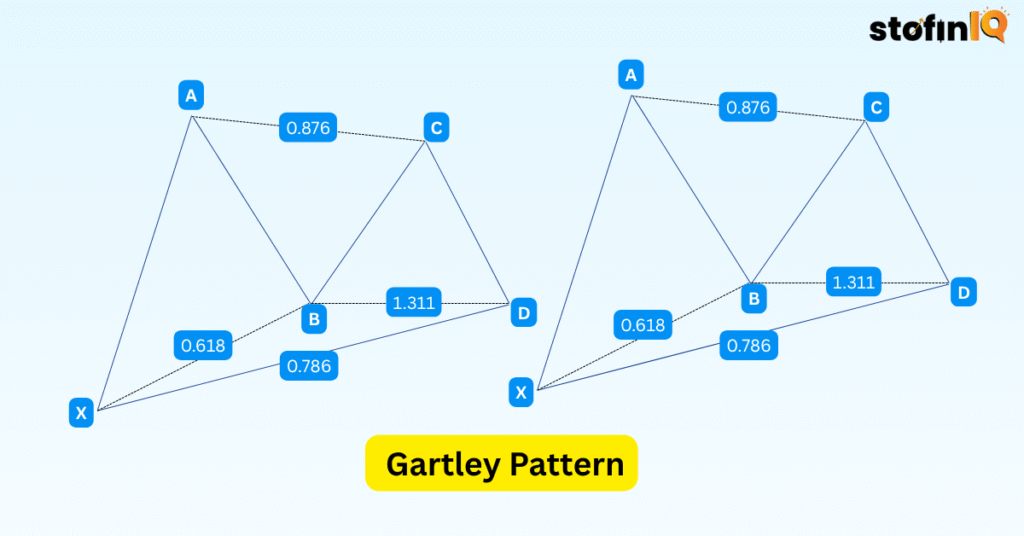

1. Gartley Harmonic Pattern

This pattern was created by HM Gartley and It is one of the most popular harmonic patterns, the Gartley pattern signals a reversal and consists of four legs labelled X-A, A-B, B-C, and C-D. The stop-loss point is often positioned at Point 0 or X and the take-profit is often set at Point C.

Fibonacci Levels:

- AB should be a 61.8% retracement of XA.

- BC is mostly 38.2% or 88.6% of AB.

- The CD is usually 78.6% of XA.

This pattern helps identify turning points and helps traders capitalize on short-term price corrections. The harmonic patterns cheat sheet often places Gartley at the top due to its reliability.

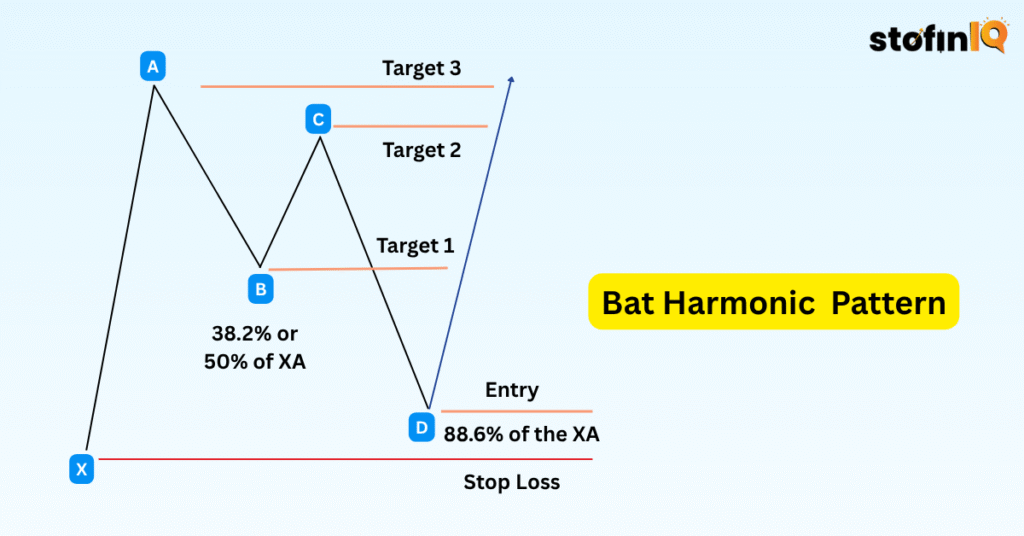

2. Bat Harmonic Pattern

The Bat is similar to the Gartley but differs slightly in the Fibonacci ratios, It has a deeper retracement and tighter risk levels. The stop loss for a Bat harmonic pattern is usually set just beyond the X point to protect against false breakouts while managing risk.

Fibonacci Levels:

- AB retraces 38.2% or 50% of XA.

- The CD should be 88.6% of the XA leg.

- The pattern finishes before the X point, ensuring a tight risk-reward setup.

The Bat is valued for its accuracy, making it a frequent entry on any harmonic patterns cheat sheet used by seasoned traders.

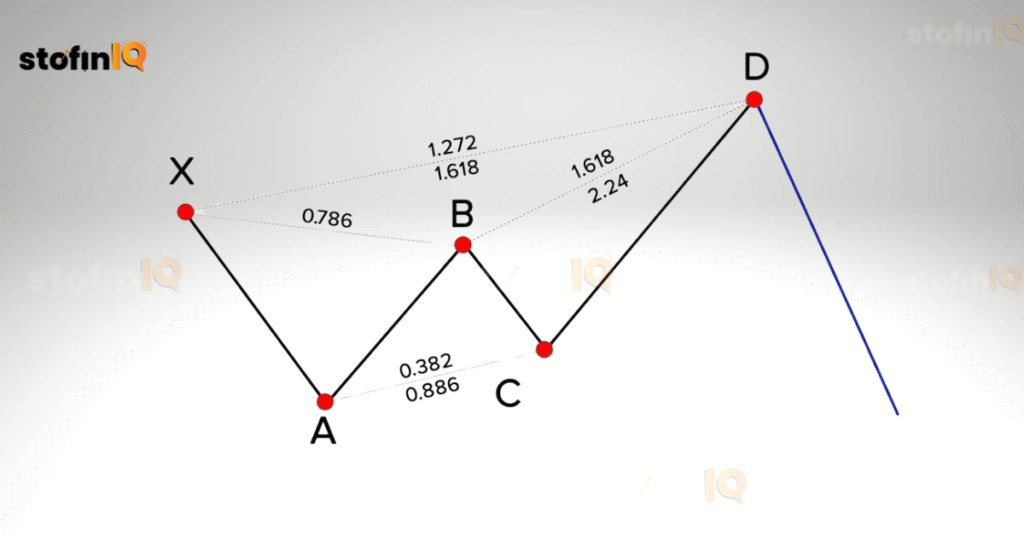

3. Butterfly Harmonic Pattern

The Butterfly indicates price exhaustion and is typically found at the end of extended moves. The stop loss of the butterfly harmonic pattern is typically set just beyond the small distance from the X point of the pattern. This ensures that if the price moves against your position, your loss is minimized.

Fibonacci Levels:

- AB is 78.6% of XA

- CD stretches beyond X, typically reaching 127% or 161.8% extension.

Since the CD leg extends beyond the X point, traders must use caution. However, with the right harmonic patterns cheat sheet, spotting this pattern becomes much easier.

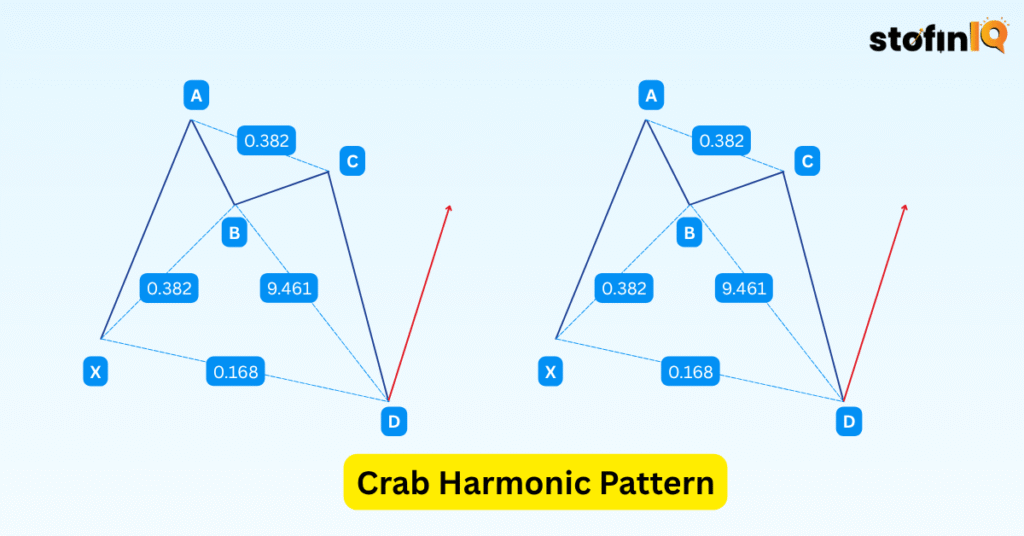

4. Crab Harmonic Pattern

The Crab is known for its extreme projection in the final leg and offers one of the best risk-to-reward ratios. The stop loss for a crab harmonic pattern is typically placed just beyond the X point of the pattern. This is to protect against false breakouts and to account for potential price volatility.

Fibonacci Levels:

- AB is 38.2% or 61.8% of XA.

- CD is an extended 161.8% of XA.

The extended D leg means a significant potential reversal. Proper usage of this pattern requires strict adherence to Fibonacci levels, which is why it’s a key element in every harmonic pattern cheat sheet.

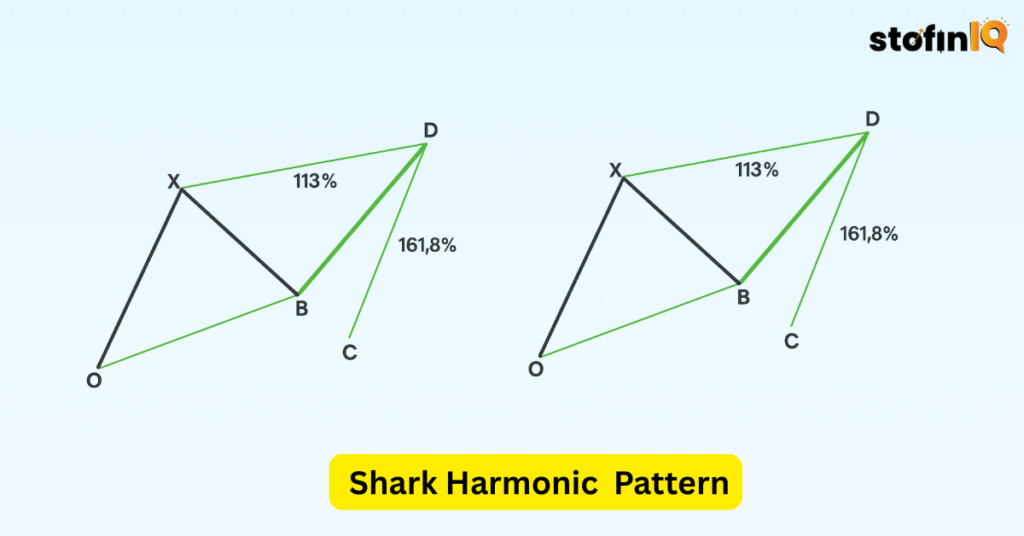

5. Shark Harmonic Pattern

Unlike other harmonic patterns, the Shark is a newer formation that doesn’t conform to the traditional XABCD labelling but is still rooted in Fibonacci analysis. The stop-loss for the shark pattern is set a few pips below the candlestick pattern at point C, in the case of the bullish shark pattern. For the bearish shark, the stop loss level is set a few pips above the bearish candlestick pattern at point C.

Fibonacci Levels:

- Point C is 113% of the initial impulse leg.

- The D point is found at a 161.8% extension.

This pattern is particularly useful in volatile markets and is becoming increasingly common in modern harmonic patterns cheat sheet.

6. Cypher Harmonic Pattern

A relatively advanced pattern, the Cypher is rare but offers a high-probability setup when identified correctly.

The stop-loss for the Cypher pattern is generally placed slightly above point X for bearish patterns and slightly below point D for bullish patterns. Doing this, you get the surety that if the price moves in the opposite direction of the anticipated pattern, the trade is closed to minimize losses.

Fibonacci Levels:

- AB is 38.2% to 61.8% of XA.

- BC retraces 127% to 141.4% of XA.

- The CD is a 78.6% retracement of XC.

Though complex, this pattern offers smooth reversals when executed well and remains a must-know in a comprehensive harmonic patterns cheat sheet.

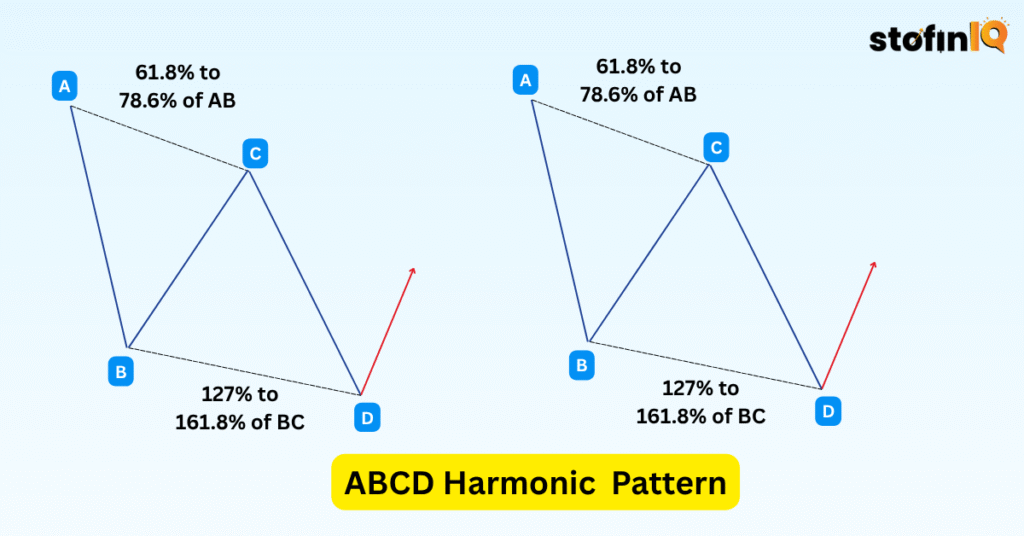

7. ABCD Harmonic Pattern

A classic and foundational harmonic pattern, the ABCD is one of the simplest yet most effective setups used by traders. Recognized for its symmetry and straightforward structure, it serves as the building block for more complex patterns.

The stop-loss for the ABCD pattern is commonly placed slightly beyond point D—above it for bearish patterns and below it for bullish patterns. This ensures protection if the price breaks through the expected reversal zone, limiting potential losses.

Fibonacci Levels:

- AB is a retracement of 61.8% to 78.6% of the initial leg AC

- CD typically mirrors AB in both time and length.

- The ideal point D forms when CD is 127% to 161.8% of BC

Traders appreciate the ABCD for its ease of spotting and high reliability when paired with confluence zones or support/resistance levels. While simple, its accuracy makes it an essential part of any harmonic trading strategy.

Why Use a Harmonic Patterns Cheat Sheet?

Since there are many structures and Fibonacci ratios to keep in mind, harmonic patterns cheat sheets can really become handy for traders. This allows the trader to have a quick reference and help secure the accuracy when identifying the patterns. The traders do not have to memorize every ratio. But they can just look at the cheat sheet and rely on it for the trading decisions.

Difference between harmonic patterns and Candlestick patterns:

Technical analysis employs both candlestick and harmonic patterns as tools, although their functions and underlying theories are different. Candlestick patterns are brief visual representations of market mood, such as bullish or bearish reversals, that are produced by one or more candlesticks. They are frequently utilised for short-term decision-making and are easy to identify, such as the Doji, Hammer, or Engulfing patterns.

On the other hand, harmonic patterns are more intricate price structures that are founded on geometric symmetry and exact Fibonacci ratios. These patterns, like the Butterfly or Gartley, are designed to forecast possible reversal zones over an extended period of time. Harmonic patterns are predictive, suggesting possible reversal points before they occur, whereas candlestick patterns are reactive and based on recent price movement.

Congratulations on finishing the blog! Your analysis will be much aided by this blog, Follow our blog StofinIQ for more interesting material and updates if you wish to enhance your knowledge about the stock market, mutual funds, and finance generally. Here marks your path to financial literacy!

Reference:

I left my engineering job to follow my true passion writing and research. A passionate explorer of words and knowledge, I find joy in diving deep into topics and turning rich, insightful research into compelling, impactful content. Whether it’s storytelling, technical writing, or brand narratives, I believe that the right words can make a real difference.