What are the 2 Golden Rules of Personal Finance ? lets Checkout

The 2 Golden Rules of Personal Finance are (1st one) to pay yourself and (2nd one) to live within your means.

But the most important quote or the Golden Rule we can say is, “Save First, Spend Second”

This article approaches the rule of Managing personal finance which can help you out in tough situations also learn what are the traditional approach of the fiance and how it was integrated with the 50/30/20 rule.

Table of Contents

ToggleUnderstanding the Traditional Approach

In the Traditional approach, the main focus was on earning more funds to grow the business. Companies following in early times it was usually implement the following measures to maximize their profits: Maintain accounting and make legal relationships between investors (source of funds) and the firm.

What are the Budgeting Rules of Personal Finance?

In personal finance, there are many rules like the rule of 70/30 rule of 50/30/20, pay yourself first these are some rules which you can we have broken down with links for you

The Golden Rule Approach for You:

Live within your means: it means you are spending less than what you earn

Save: Save 10% of your income, or start with what you can save.

Separate wants from needs: understand the difference b/w essential needs and wants This helps you make unnecessary expenses

Emergency Fund- make an emergency fund which can help in your bad times

Pay off high-interest debt: generally high-interest loan is the key which is a big factor in you are losing your financial grip

Make some money goals: Set goals for your money.

Make some good investments: Put your money in high-interest savings accounts or investment products.

Follow a budgeting strategy: You can use budgeting rules like 50/30/20 or 70/30 so these rules will help you.

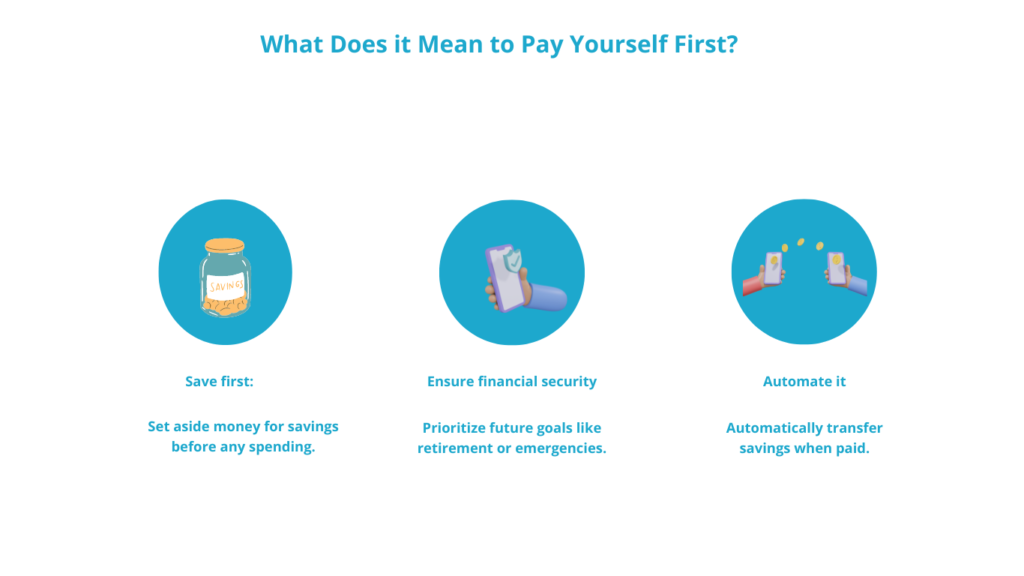

What Does it Mean to Pay Yourself First?

In the first pay-yourself method, you have to make a small amount of your paycheck into your retirement fund, some emergency fund, or other goal-based savings account before you spend any of it. A tip for you is when you get paid save some amount, so then your monthly spending naturally adjusts to what’s left.

The Easiest Way to Pay Yourself First?

The most easy way to save is to pay yourself first. That means every time you get paid or get a salary you can try to put some portion of the amount in a savings account. See if you can manage to make a portion of your savings account remember a certain amount from your paycheck will become bigger in an emergency.

What are the Differences Between Wants and Needs?

The need is an essential part of life. Earlier it was, housing and clothing food but nowadays the need has changed. Needs are making people push to work; they include grocery, rent / emi of house, medical bills, school/tuition fees of children, electricity bills, wifi, phone recharges, salaries of house-help and needs also include like if you’re addicted to smoking, drinking or anything till the day you stop it, it comes under the category of need.

Now let’s talk about Want – A want is something that you demand from yourself you may get questions like what I am doing in life if you are not enjoying so all of these enjoyments come in wants which can be expenses for outings, gym, adventurous trips, spending on games, subscriptions, gadgets, cars, gifts for someone, etc

Please remember and read the data that People who are focusing more on wants are paying high emi people who focus more on needs are investing but even after having money they think before spending so you need to think about which one side you are on.

How to Pay Debt Fast?

- Figure out how much you owe.

- Focus on one debt at a time. Start with the loans or any credit card bill that has the highest interest rate and make the minimum payments on your other cards. …

- Put any extra money toward your debt.

- Embrace small savings.

2 Golden Rules of Personal Finance with 50-30-20 Rule

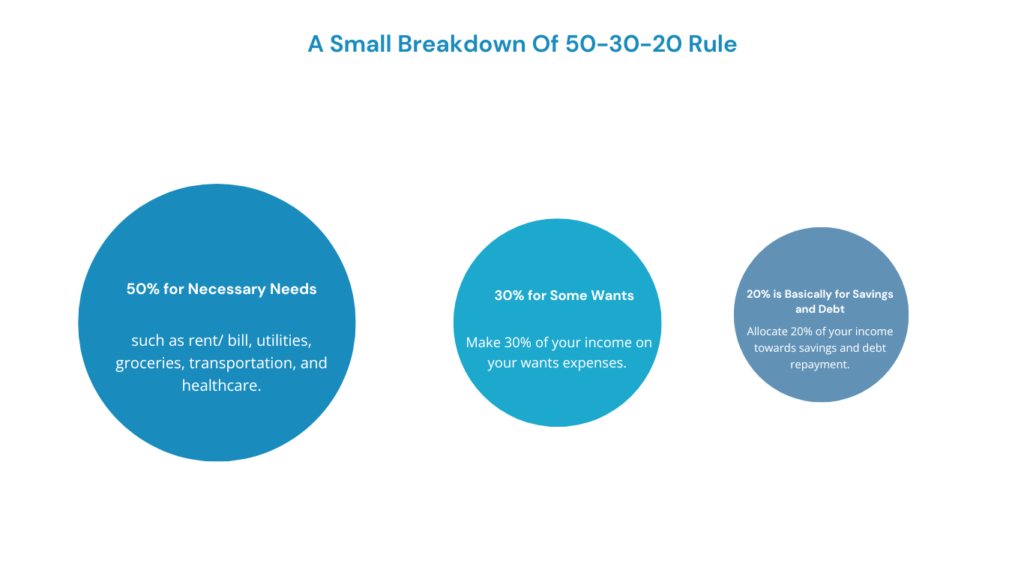

The 50-30-20 Rule says you to your total income into three portions. The first portion is 50% of the income, which goes for needs; the second portion would have 30% of your income, which goes toward wants, and the rest 20% of income would go to the third portion which is savings and investing.

A Small Breakdown Of 50-30-20 Rule

- 50% for necessary needs: Invest 50% of your income to cover important needs such as rent/ bill, utilities, groceries, transportation, and healthcare.

- 30% for some Wants: Make 30% of your income on your wants expenses.

- 20% is basically for Savings and debt: Allocate 20% of your income towards savings and debt repayment. Which aligns with the concept of “Paying Yourself First” from the golden rule.

Benefits of Managing Personal Finance

- Financial planning is much more than just saving and investing — we know that those two are important components, a effective financial plan makes your needs and want acc to your earnings.

- The key profit of effective and efficient personal finance planning include reduced stress and anxiety, financial security, the ability to make, improved decision-making, and increased confidence and control.

- Setting financial goals

- Budgeting and tracking expenses

- Building an emergency fund

- Managing debt

- Creating an investment strategy

How Much Should Be Emergency Fund?

Look your emergency fund depends on your income if your monthly expenditure is high and your income is less than it should be your first goal is to save money then you can think of an emergency fund. But the ideal size for an emergency is up to 3-6 months.

In Summary

In Conclusion, we would say that the 2 Golden Rules of Personal Finance is not fulfilled till you start paying yourself first, and living by your means is the key to achieving financial planning independence also if you separate your needs and wants it will help you financially, and including budgeting rules like 50/30/20 can be a xfactor for your financial condition growth

FAQs related to personal finance

Q1What is the 1st Week Rule

To bring discipline in investing, personal finance experts advise you to save and invest the 20% allocated amount for savings from your income in the first week itself.

Q2 Some Rules for Personal Finance

The rules for personal finance are One fits into the other. Clearing out your wants from your needs is actually very helpful for some people. Also if you have a positive money mindset you need to start saving and through this progress, you can look at your financial situation and want to live within your means.

Q3 What Technique is the 80/20 Rule?

The 80/20 Rule also known as the (Pareto principle), The 80/20 Rule, emphasizes the significance of prioritizing your most critical needs. This principle suggests that 20% of your efforts can lead to 80% of your results. It is not a mathematical equation but rather an observation that can be applied across various aspects of life. In the realm of personal finance, for instance, it is evident that in sales, 80% of the results often stem from just 20% of the transactions.

Q4 Explain the rule 72 in Personal Finance

In personal finance, the rule of 72 is used to find for investment growth, particularly when dealing with savings accounts, or stock market returns. The basic idea for using this rule is to determine how fast our money will get doubled by this fixed rate of return Remember this rule makes complex financial planning more accessible for long-term benefits

Q5 How can I know what’s fit for as a need vs a want under in the 70/30 rule?

Needs are those important costs that keep you living basic lives, such as rent, utilities, basic food items and debt payments. Basically “Wants” are considered those things you don’t need to live but make life like you went on an adventure trip with your important this is a prime example of wants

I'm Abhishek, a passionate and creative professional dedicated to making waves in the dynamic world of digital marketing. Today, I'm proud to bring my skills and experience to StofinIQ, where I thrive , delivering impactful content and innovative strategies to inspire and engage audiences.

Post Comment