Is the Trading Luck or Skill? let’s Understand

Is the trading Luck or Skill? Well, Trading is gambling, a power, a game in which maybe you can win money or even lose.

Let’s understand what the data says In January 2023, SEBI released an analysis report on Financial Air 2022 in which it warned futures and options traders.

According to the report of SEBI, the total individual trades traded in futures and options in Financial Air 2019 were around 7.1 which is around 7.1%.In 2022, about 45.2000 means an increase of 500 almost 36%, and out of this, 88% are individuals and active traders.

So, if you also want to do trading not as a power but as a business, then you will also have to avoid those mistakes that 89% of people are making.

The next day he took a trade to recover his loss and this time again he suffered a loss of Rs 32000 in just three days of starting such an options trading, Akash gave 60% of his capital to the company and Akash is not an example.

No, many people like him give away more than half of their capital within a few days of getting into options trading and make people think that is trading luck or skill.

Table of Contents

ToggleKey Points

Trading as a life skill: Trading provides financial independence, which allows individuals to pursue other ventures without relying only on a traditional job.

Asses Risk in trade: Businesses need to manage trade risks like exchange rate fluctuations, political instability, and supply chain disruptions to maintain profitability.

Luck vs.Skill in Investing: If you bet only on luck then we will say it is wrong but you can try making a proper plan by gaining education and experience you can make good decisions.

Avoid Overtrading: Trade: Firstly be wise to yourself and avoid over-trading. Look, don’t run after the number of trades.

You may have to take some bell research trades so that your strategies and risk management always remain under control.

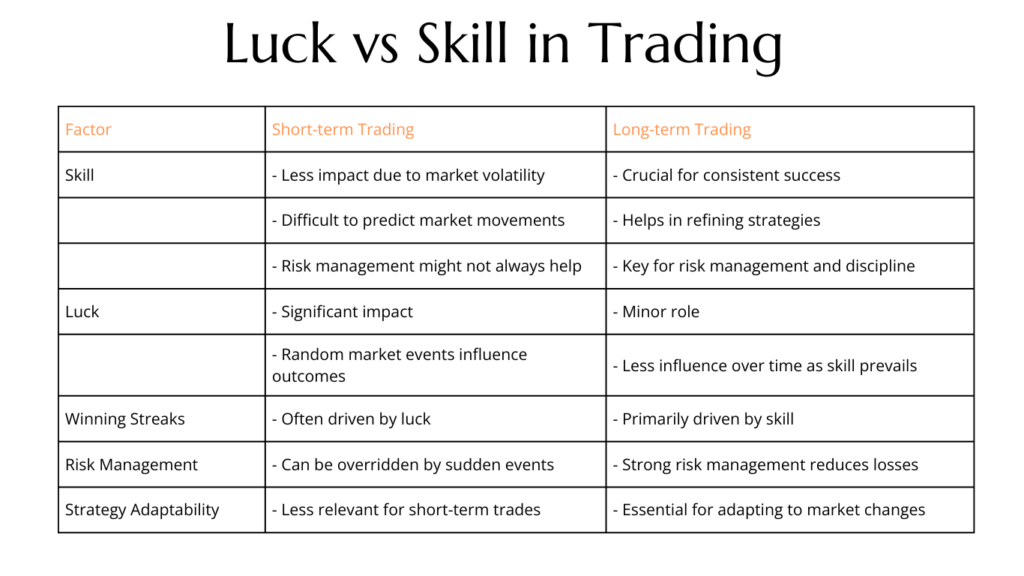

Luck vs Skill in Trading

If you see the role of luck in trading Can help you in starting but it can’t hide that part that trading is a game of skill as well.

We need to understand that trading is not a game of chance. It is actually a very complex process that requires a deep understanding of the market

Some Example

Let us tell you the story of Akash Sharma from Indore

On 16 Nov 2019, Akash started trading for the first time but he was a teacher also.

He was very excited when he started because he thought that he would be able to earn extra income from trading.

Before starting trading, he had learned a little by watching videos on YouTube and now he was ready for practical.

Initially, he started with ₹ 1 lakh. And with this, he started doing options training.

He took his first trade in Bank Nifty and in just 5 minutes of taking the trade, he made a profit of Rs 24000.

Seeing this profit, he thought that even after studying for the whole month, I could not do this much.

Due to this, his confidence flooded a lot, now Next De Akash had bought an option yesterday but unfortunately, at the time of increasing the option there was an event and Next De suffered a loss of more than ₹ 40000. After doing this last Akash became very sad.

When to Enter and When to Exit

In trading, it is important to have a plan for every trade. You should know at which point you will enter and at which point you will exit.

You should know how much it is and what your profit target is. You must have to analyze the market and check enter and exit trades. Profitable traders always have a plan and streets ready for their trades.

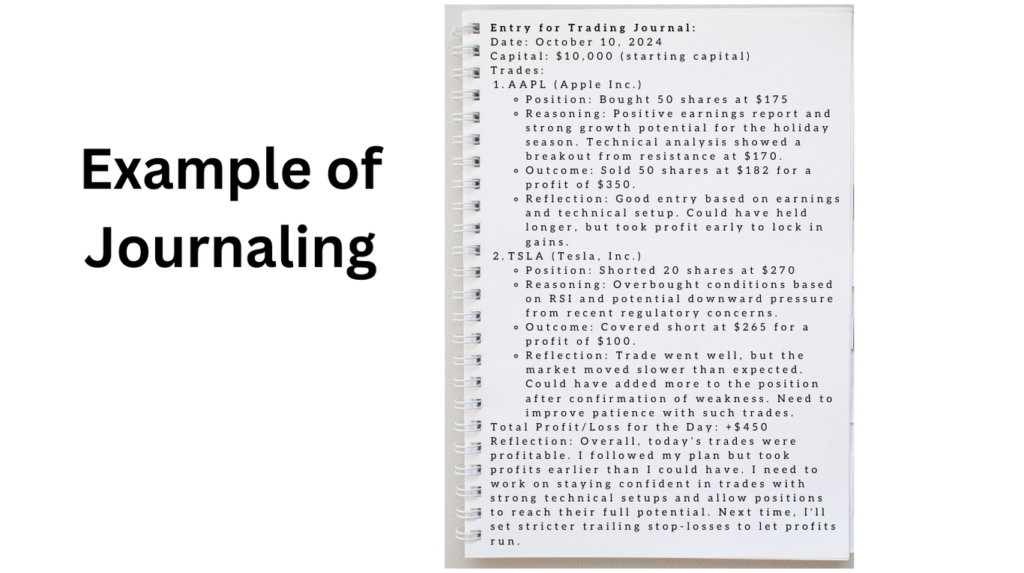

This will help them to know how and when to trade. When to take and when to leave your trade the big mistake is not learning anything from your mistakes. For this, you can do journaling

Journaling is the process of recording your traits by writing and later analyzing them so that you can identify patterns and mistakes you have made and learn from them to make better trading decisions.

Risk Management in Trading

The basic and biggest risk in trading is favor luck but you can cut it down by using risk management which simply means controlling the risk of your loss in trading but how will you manage your risk?

The Conclusion

Well if you are still hanging between Is the Trading Luck or Skill then you need to understand that Trading requires both luck and skill.

While luck can lead you to short-term gains, relying only on it is risky on the other hand skills ensure sustained success through proper planning, risk management, and learning from mistakes.

You can see the Key strategies which are managing risk, avoiding over-trading, and having a clear plan for when to enter and exit trades.

Some FAQs on Is the Trading Luck or Skill

Q Is option trading a skill or luck?

Ans Options trading is not just based on luck. But the right knowledge and understanding of the market can make a big difference so you need to understand and wait for big profit.

Q Why is risk management important in trading?

Well, risk management is important for you in trading for handling significant losses. In risk management, you need to assess your risk tolerance and be aware of the risk-reward ratio before every trade.

Q How can a journal help me?

Ans Look a journal is actually a way to track your trading performance it holds the record of your past performance in trade so it gives you feedback on which ones are your successful trades and which ones are not.

Q Is overtrading harmful for me?

Ans Overtrading happens when a trader makes too many trades in very little time, it can be harmful to you. Overtrading is generally called poorly planned trade,

QSome references for the article

I'm Abhishek, a passionate and creative professional dedicated to making waves in the dynamic world of digital marketing. Today, I'm proud to bring my skills and experience to StofinIQ, where I thrive , delivering impactful content and innovative strategies to inspire and engage audiences.

Post Comment