Importance of Personal Financial Planning in 2024

The Importance of Personal Financial Planning is much more important nowadays because we have seen some unexpected incidents in our lives and we know how important for you to make a plan for the your long term financial goals. If you start today then maybe you enjoy the rest of your retirement life without depending on others.

Table of Contents

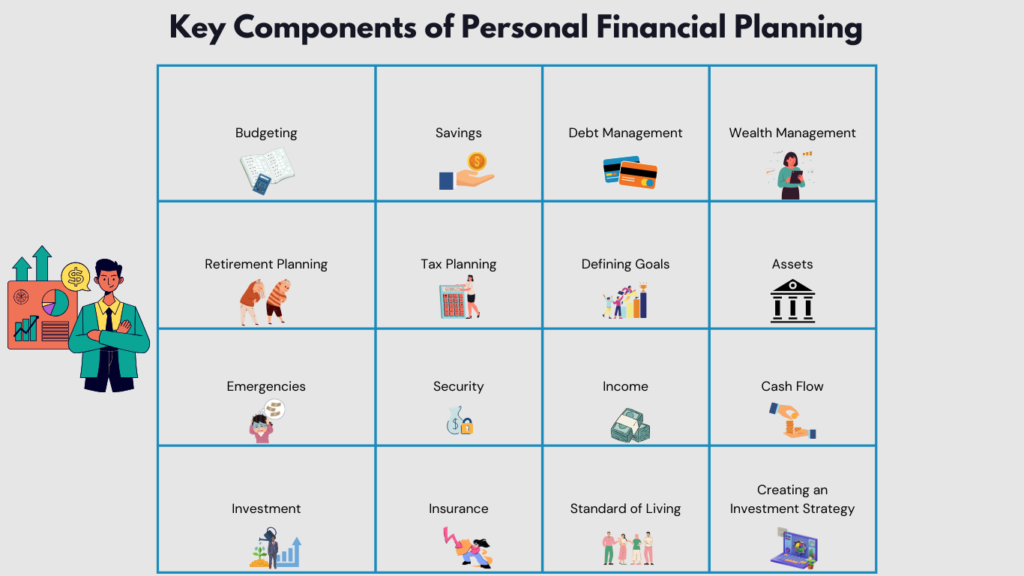

ToggleWell Personal Financial Planning Contains Some Key Points

Budgeting

Budget means making a plan for how you are going to spend your money. Basically creating and making a plan will let you know that how much money you are spending on your needs and how much is on unnecessary wants. Follow the 70/30 rule and adjust regularly to ensure financial discipline

Savings

It is basically an amount how much you get in the end after spending on all of your needs and wants. When you make a budget it will tell how much you saved in the last so budgeting will help you in saving as well.

Debt management

Debt Management in personal finance is actually a way to get your debt in control. Your focus should be on making debt free yourself you can make a change in needs and want to get your debt payoff aggressively

Retirement planning

Basically, Retirement planning means making a clear-cut plan for yourself for after life of retirement. it becomes more efficient with the help of estimating the amount how much you need after your retirement.

Tax planning

Tax planning in financial planning means management of your all taxes also checking your all deductions is very important it contains the 5 DS which are deducting deferring disguising dividing and dodging to save tax.

Defining goals

Defining the financial goals for you is quite necessary remember everyone has some big goals in their life like marriage schooling any big trips so for these you can define your goals. If you are any firm owner then for you It contains majorly four things stability, liquidity, profitability, and efficiency.

Emergencies

We all know that life is not gonna similarly every day so that why it is important to make an emergency fund in your budget things like job loss, medical problems even for your car you need an emergency fund that will give you help in low times

Security

Security is something that means how much debt-free you are living in your life or how much secure funds you have in an emergency situation. In other definitions, Security in personal finance means a wide area of your investments that covers stocks, bonds, etc

Income

Income means the total money you earn or receive individually in various ways from job, freelancing, teaching, etc that is called your income remember income has so many definitions but in large it is all about total income.

Investment

The Investment process in financial planning majorly covers your asset allocation and diversification, assessing risk factors.

Insurance

Insurance in personal finance is important because it generally reduces financial uncertainty comes to you it will help in case your income is less it is a type of contract or policy between a person and a policyholder.

Standard of living

The standard of living in personal finance refers to your wealth, comfort, and material goods which you earned in life, and how much financial fit you are.

Creating An Investment Strategy

In finance, the investment strategy is important for you it needs a set of rules, procedures, and behavior and also a guider who can help you in investments these are the things required for creating a good investment strategy.

Wealth Management

Wealth management is basically a comprehensive combination of financial planning and investment management it contains things like budgeting, retirement planning, tax strategies, estate planning, and risk management.

Assets

An asset is something that can help you in the future by making you economically strong it is the opposite of liability it can be your property like rental property or

Cash flow

Cash Flow in personal finance means how much money was credited and debited from your bank accounts. If you’re bringing in more than debating then it is called positive cash flow.

The Conclusion

Lastly, we will say to you that personal finance is essential also with the help of a structured plan you can be financially stable and secure your future. make sure your goals are for long terms because in finance time is important Also With a clear understanding of your income, assets, and financial goals, you can make informed decisions that improve your standard of living and ensure a comfortable and debt-free future. Starting today, even with small steps, you can be more financially secure tomorrow.

FAQs for You

Q1. How do I create a budget and stick to it?

First, assess your income. Categorize expenses, set realistic limits, and track spending. Follow the 70/30 rule, automate savings, and adjust regularly to ensure financial discipline.

Q2. How should I manage and pay off debt?

Give priority to high debt, make consistent payments, and avoid new debt. you can follow debt snowball or avalanche methods to gradually pay off balances and reduce financial stress also try to reduce your needs and wants.

Q3. How do I start creating a financial plan?

Start Identifying your financial goals, assess current finances, create a budget, and build an emergency fund. You can Include savings, investments, and debt management strategies tailored to your long-term goals.

Q4. How can I protect my assets and wealth?

Try to Use insurance policies, diversify your investments, and then create an estate plan. Regularly review and adjust your financial strategies to minimize risks and protect your wealth from unexpected events.

Q5. Is it important to work with a financial advisor?

Yes, a financial advisor can offer you advice, especially for complex finances, investments, or retirement planning, which helps you to make informed decisions and achieve your financial goals efficiently.

I'm Abhishek, a passionate and creative professional dedicated to making waves in the dynamic world of digital marketing. Today, I'm proud to bring my skills and experience to StofinIQ, where I thrive , delivering impactful content and innovative strategies to inspire and engage audiences.

Post Comment