A Beginner’s Guide to Trading Future

Are you eager to learn about Trading futures? We all wonder what trading futures is, so today, we’re going to tell you about it.

Basically, futures trading is nothing but a contract of buying and selling future assets. Assets can be anything, such as gold, wheat, oil, etc.

Table of Contents

ToggleHere are the steps in the table for Beginners Trading Future

Open Account | Find a good and reputed trading platform and open an account. |

Select a Market | The next step is you decide the market in which want you to invest. ex forex commodities or indices. |

Analyze the Market | Then analyze the Market you can use technical and fundamental analysis. |

Place an Order | Enter the correct information about your trade for buying or selling on the platform |

Margin Requirement | Put down a small amount of money for controlling larger trade. |

Executing the Trade | The trade is executed when the conditions specified in the order are met. |

Managing the Trade | Monitor the trade, adjust positions, and set stop-loss/take-profit levels. |

Settlement | The trade is settled either by delivery of the asset or cash settlement. |

Closing the Position | Execute an offsetting trade to realize profits or limit losses. |

Settlement | Analyze the outcomes of your trades and refine your trading strategy. |

Here are Some Advantages and Disadvantages of Trading Future

Advantages | Description | Disadvantages | Description |

Leverage and Higher Returns | It can help you in Higher Returns. | High Risk and Loss Potential | Leverage can give you losses as well, potentially leading to significant financial damage. |

Diversification | It gives access to commodities, indices, and currencies. | Complexity | You Require a good knowledge of the market, for contract and trading strategies. |

Liquidity | High trading volume ensures easy entry and exit from positions. | Margin Calls | The market may not work for you every time so you need more funds in deposit to maintain your position. |

Hedging | It also Protects you against price fluctuations in underperforming assets. | Volatility | The future markets are highly volatile, it can lead you to rapid and unpredictable price movement |

Transparency | Standardized contracts and regulated exchanges provide clear pricing and reduced counterparty risk. | Time-Sensitive | Futures contracts have expiration dates, which may require rolling over positions or closing them at a loss. |

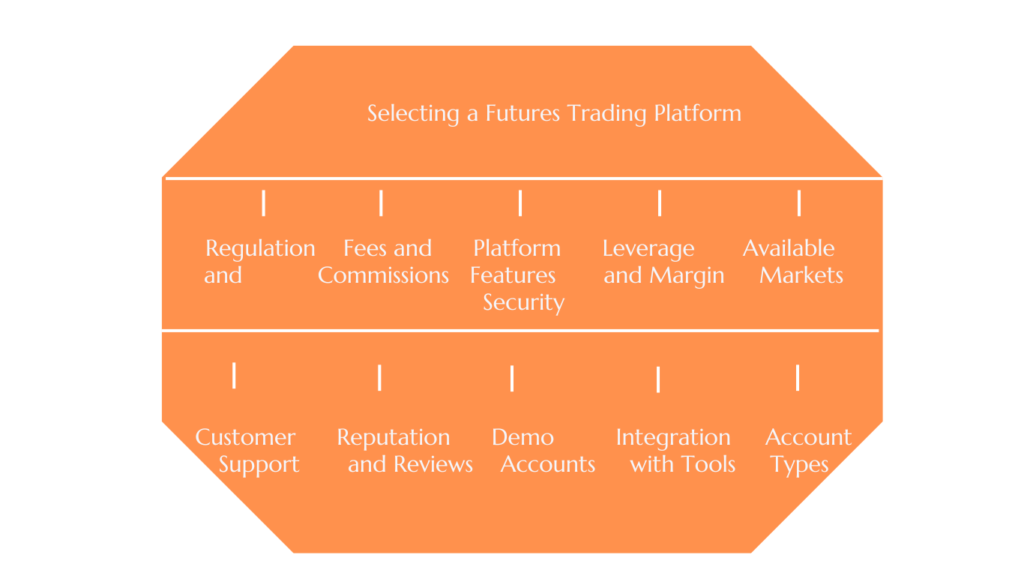

Selecting a Futures Trading Platform

Choosing the Right Trading Platform is crucial for your future trading you need to check these points while selecting the platform.

User-Friendly Interface:

Advanced Charting Tools:

Real-Time Data:

Order Types:

Execution Speed:

Risk Management Tools:

Integration with Other Tools:

Mobile Access:

Customer Support:

Educational Resources:

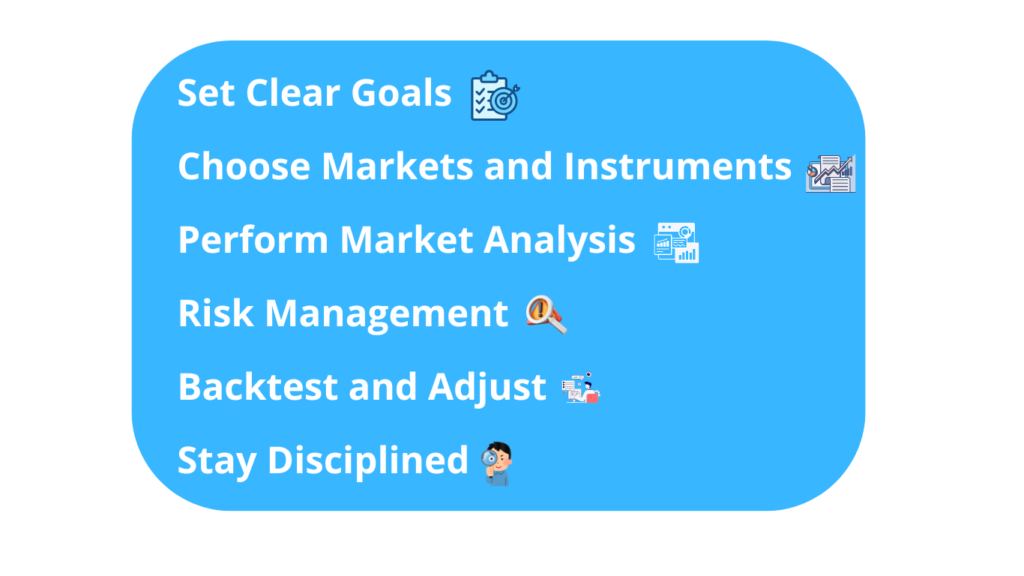

Developing a Future Trading Plan

Visualize The Markets To Identify Trading Ideas

A trading strategy usually begins with one or more indicators on a chart. Then, rules form trade setups and triggers. NinjaTrader’s customizable trading charts offer over 100 indicators and more than 10 chart styles. These tools help you find and focus on trading opportunities.

Verify Your Trading Ideas Through Testing

Trading strategies can tested on different symbols and timeframes. A trader called Ninja Trader can allow you to use a backtesting engine which allows you to maintain your trading strategies on data and analyze their previous performance.

Protect Your Trading Positions

Ideally, trading strategies have risk management built into the trading rules and logic. NinjaTraders’s Advanced Trade Management (ATM) protects open positions with automatically submitted stop and target orders and self-tightening trailing stops which also helps to eliminate emotions from your trading.

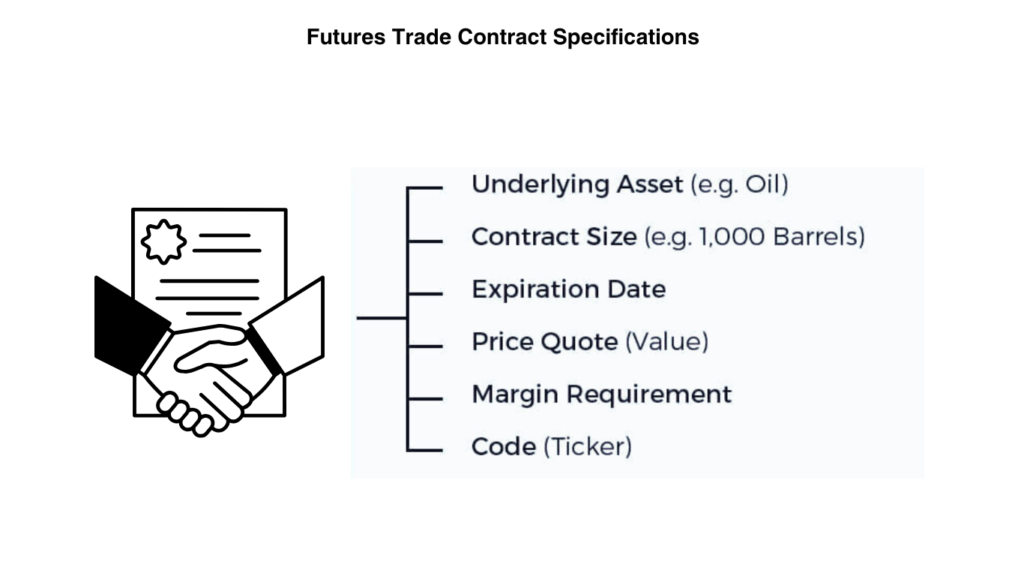

Contract Specifications

In the future, each standardized contract will include several elementary specifications:

- Symbol: Each product has a designated symbol, which is then combined with individual codes representing calendar month and year. In December 2019 a company called corn futures was listed for trade on the CME Globex as “ZCZ9.” This notation includes the base symbol of ZC, followed by a “Z” for December, and “9” for the year 2019.

- Trading hours: Session opening and closing times vary according to a variety of factors, including asset class and related markets. Each product’s business hours are listed in its specs.

- Expiry: A contract’s expiration date is given to signify when it will cease to be traded.

- Settlement: Either physical delivery or financial adjustment is designated for each contract’s settlement.

Futures Markets to Trade

Category | Description |

Agriculture | In agriculture, the future contracts are like crops wheat, coffee, and sugar, as well. |

Energy Commodities | There are some energy commodities for you to invest like oil, natural gas, gasoline, and heating oil. |

Metals | You can trade in some metals like gold silver platinum |

Futures vs Options | Futures provoke the buyer to purchase the underlying asset, whereas options give the buyer the right without the obligation. |

Financial Futures | |

Stock Index Futures | Stock index futures investment contracts are mostly linked to market indexes which are S&P500, Dow Jones, Nasdaq, etc. |

Currency Futures | This service includes some popular currencies like U.S. Dollar, euro, yen, and pound sterling. It also deals in Bitcoin and Ethereum. |

Interest Rate Futures | Involves government bonds like U.S. Treasury bonds and various interest rate instruments. |

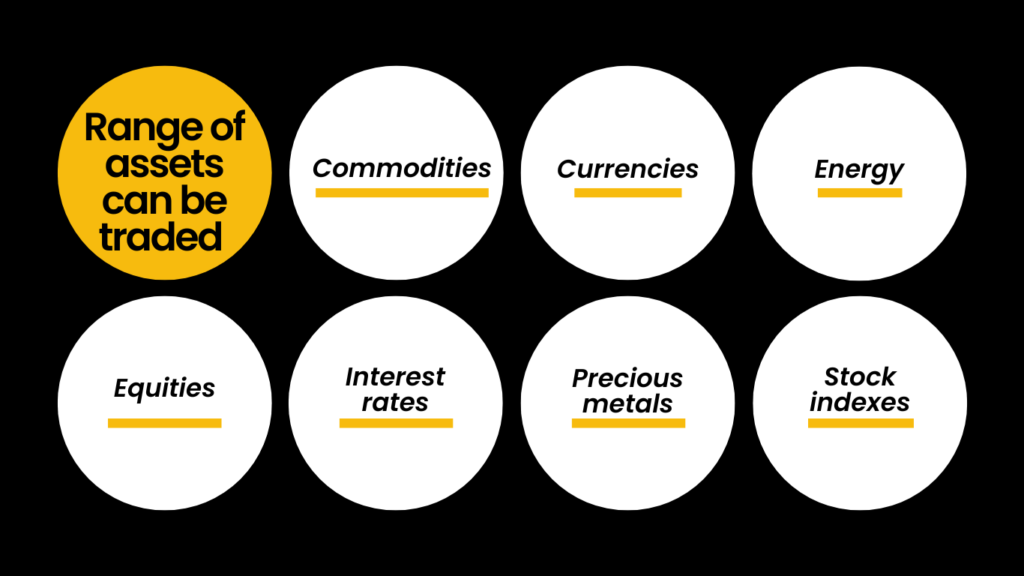

What Assets Can Be Traded Using Futures?

There are some assets like grains, livestock, energy, currency, and even security lets we tell you about trade in the future in detail.

Commodities

In commodities, it involves things like precious metals like gold and metal energy items like natural gas and crude oil you can use these assets to trade and achieve their financial goals

Stocks

One most important assets for you can be equity or shares these are available for most trades and also fulfill your need for long-term investment and short-term investment.

Currency

In currency, you can make predictions like how much the two currencies are going to exchange in the future. Traders can invest because in currency traders have high net worth market forex is a good currency in which traders can invest.

Stock market indices

Stock market traders can trade for Nasdaq, Dow Jones, and S&P 500 which allow traders to bet on the overall market performance rather than individual stocks. This helps in diversification and is a way to protect the individual from market risk.

How does Margin Work in Futures Trading?

Margin is nothing but a small deposit required by a broker to manage the future contract. It protects both traders and brokers from potential losses on an open trade. The margin amount is usually 3-12% of the contract’s total value which allows traders to leverage larger positions with a smaller investment. This can increase potential profits but also increase risk, as the losses can exceed the margin if the market moves unfavorably.

What is Fundamental Analysis and What is its Method?

Fundamental analysis is a method that is used to find the true value of a stock by checking various factors that affect the worth of the stock.

Key focus of fundamental analysis It checks the financial health of the company, industry position, and broader economic conditions.

Objective: it objective is to Determine if the stock is undervalued, overvalued, or fairly priced.

Long-Term Approach: It helps traders Look beyond short-term price fluctuations.

Decision Making: It Helps traders decide whether to buy, hold, or sell based on the stock’s real value compared to its market price.

Goal: It finds opportunities for traders where market prices differ from the stock’s actual value.

What are Interest Rates in Futures Traders Used For?

Interest rates are generally used to protect against changes in interest rates. It allows investors to secure a price for an interesting bearing in advance. It helps when the contract expires the investor the person who invests gets a security that they decided earlier. Which helps manage potential losses if interest rates fluctuate.

Here are the key points of interest rates.

- Hedging: It Protects against interest rate fluctuations and locks in prices for interest-bearing securities.

- Risk Management: The risk management is for Long bondholders who can sell interest rate futures to offset potential losses from rising rates.

- Market Sentiment: It Reflects the investor expectations about future interest rates, influencing futures prices.

- Speculation: Traders can make a profit by predicting significant changes in interest rates beyond current market expectations.

- Delivery Mechanism: Physically delivered futures allow the transfer of the underlying interest-bearing security upon expiration.

- Price Reactions: The Futures price adjustment is based on expected interest rate movements, either rising or falling.

- Investment Strategies: It was used in various strategies to manage interest rate risk across portfolios.

Conclusion

Futures trading can help you manage risk, spread out your investments, and make guesses about market trends. But because it can be very unpredictable and involves borrowing money, you need to understand how the market works, analyze it carefully and manage your risks well. If you’re new to trading, you should take the time to learn important ideas like margin, contract details, and market analysis.

FAQs of Trading Future

Q1 Is future trading profitable?

Ans A future trader be profitable but you need to find correct directions that are important and can be a golden move. But there is a huge risk if you find the wrong directions.

Q2 How much money is required for futures trading?

Ans See in trading future contracts they involve margin payment. The volume of margin totally depends on the stake size. Mostly the brokers asked for at least 10 percent.

Post Comment