What is the 50-30-20 Rule in Personal Finance?

Start by taking a look at your Salary slip or credited income. If taxes are taken out, subtract that amount from your total earnings. Also Do not subtract other amounts that may be taken or automatically deducted, like insurance of health or retirement.

The 50-30-20 is a rule where we need to put 50% of our income into needs, 30% into wants, and 20% into savings. In Personal Finance, it is a very important rule.

Table of Contents

ToggleSome Overview of the 50-30-20 Rule

Because it depends on factors like your income and where you live, from which it puts 50% of your income for your needs which may not be enough. For example, if you are living in a high-rental area, you may have to put a large portion of your income toward housing, which makes it hard to keep your needs under 50%. So, you may required to adjust the percentages to fit in this rule.

If you are following the 50-30-20 budget method and find that you are not hitting the exact percentage targets, then it is important for you to be kind to yourself. You can work towards meeting those targets in the future. Also if you have lone then once you have paid off your loan, you will be able to allocate more of your monthly budget towards savings.

Ultimately, it’s essential to choose a budgeting system that aligns with your habits and circumstances. Additionally, using a calculator to create charts based on this method can be very beneficial for you. You can use this type of notes

Key Takeaways

If you just started managing your money can feel overwhelming. It’s important to Not only need to organize your income and expenses but you also have to make some difficult decisions about how you spend your income.

A simple way to keep it easy is to consider using a percentage-based budget that divides your monthly after-tax income into categories. There you can this percentage-based budgets like the 50-30-20 rule and 40/30/10/10 rules.

Step-by-Step Guide to Adopting the 50-30-20 Rule

Because it depends on factors like your income and where you live, from which it puts 50% of your income for your needs which may not be enough. For example, if you are living in a high-rental area, you may have to put a large portion of your income toward housing, which makes it hard to keep your needs under 50%. So, you may required to adjust the percentages to fit in this rule.

If you are following the 50-30-20 budget method and find that you are not hitting the exact percentage targets, then it is important for you to be kind to yourself. You can work towards meeting those targets in the future. Also if you have lone then once you have paid off your loan, you will be able to allocate more of your monthly budget towards savings.

Ultimately, it’s essential to choose a budgeting system that aligns with your habits and circumstances. Additionally, using a calculator to create charts based on this method can be very beneficial for you. You can use this type of notes

Key Takeaways

If you just started managing your money can feel overwhelming. It’s important to Not only need to organize your income and expenses but you also have to make some difficult decisions about how you spend your income.

A simple way to keep it easy is to consider using a percentage-based budget that divides your monthly after-tax income into categories. There you can this percentage-based budgets like the 50-30-20 rule and 40/30/10/10 rules.

Step-by-Step Guide to Adopting the 50-30-20 Rule

Track Your Current Spending Habits

- Check your account statements

- Categorize your expenses

- Build a budget that works for your expenses

- Use budgeting or expense-tracking apps

- Look for ways to lower your expenses

Understand Your Monthly Income

Identify and Prioritize Your Financial Obligations

Automate Savings and Debt Repayments

Knowing the Portion of 50/30/20 Rule for You

50% for Needs: Covering Your Essentials

Remember, Your necessities are usually your living expenses and should make up 50% of your after-tax income. Needs are actually those things you need that aren’t optional. In your wants are those things that you’d like to have but don’t need for survival purposes.

Examples of Necessities Include:

- Groceries

- Utilities

- Health care

- Student loan payments

- Rent or mortgage

- Transportation costs

- Childcare

- Insurance

- Credit card and other debt payments

30% for Wants: Budgeting for Discretionary Spending

30% of your after-tax income is for different things, especially for long-term savings like you want to buy a house or for a vacation Your wants should account for 30% of your after-tax income.

For Example:

- Subscriptions of the OTT platform

Dining out

Spa/

Designer Clothing

Club or gym memberships

Tickets to sporting events

Look spending unnecessary money on these things looks bad but you can use your want to reward yourself for working hard. You can use it for yourself to accomplish goals, But one thing is Your wants gonna change over time. So When you mark any item, you can check whether it is motivating you or not.

20% In Debt and Saving

The last 20% of your total income has to go to your savings, which is used for achieving long-term goals. So you can save for things like a down payment on a home or such if you want or something like that.

Examples of savings goals Include:

Vacation

New Vehicle

Emergency savings account

Down payment on a home

Accounts like 401k in such

If your income is directly credited to your bank, you may be able to set 80% of your income deposited in your checking account for your everyday expenses and things you want.

5 Reasons to Save Money

Developing the habit of saving money is an excellent habit that should be developed among every individual, whether you are planning for short-term or long-term goals. Firstly try to understand the importance of saving money and choosing the right plan will motivate you to earn more for achieving financial goals.

Savings Lead to Financial Freedom

- Financial freedom means you can live on your own without needing others to support you financially.

- Build a fund that is crucial to your savings goal. Emergencies can arise at times.

- Savings Lower generally Financial Stress

- Savings let you experience a fun-filled life without worrying about funds.

One of the important reasons to save your money is that you can easily take aggressive yet calculated risks with your saved money for your benefit. If you have saved a good amount, you can take certain risks such as starting a new startup or business, exploring the world, or what you desire.

What is Emergency Funds

An emergency fund is basically a cash reserve which specifically set aside for unplanned expenses or financial emergencies and troubles. Some common examples are car repairs, home repairs, hospital bills, or a loss of income.

What are Long-Term Financial Goals

The 15-16-year plan mostly revolves more around your aspirations with life and wealth creation this is called a long-term financial plan. Long-term goals include saving for a new house, your child’s higher studies, or an expensive vacation to an exotic location somewhere in Manali or a foreign trip. You can plan accordingly once you need to achieve a thoughtful balance between the two to achieve financial stability in the long term.

Financial Discipline and Flexibility

Financial flexibility is the affordance of companies to provide the financial resources to have a proper reaction in unexpected cases and events to maximize the company value Heath (1978) explains financial flexibility as the power of corrective action to remove the cash paid to be excess of the anticipated cash received with minimum effects on the present and future income or the market value of the company stock

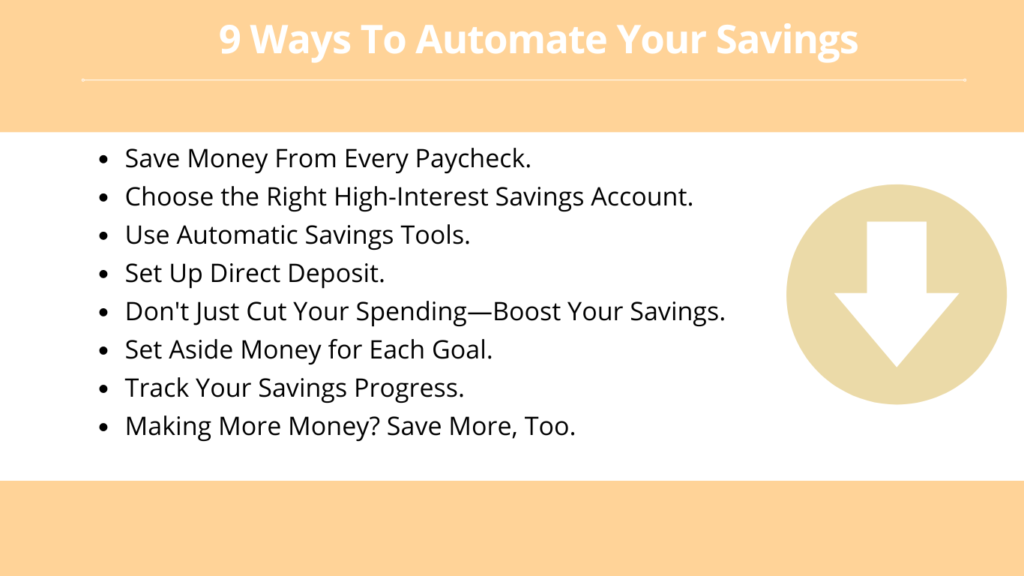

9 Ways To Automate Your Savings

- Save Money From Every Paycheck.

- Choose the Right High-Interest Savings Account.

- Use Automatic Savings Tools.

- Set Up Direct Deposit.

- Don’t Just Cut Your Spending—Boost Your Savings.

- Set Aside Money for Each Goal.

- Track Your Savings Progress.

- Making More Money? Save More, Too.

The Conclusion

Lastly, we can say that the 50-30-20 rule gives a flexible and practical framework for achieving financial balance, in which you can put 50%30%20% for needs/ wants/debt and savings but it may need adjustments depending on your circumstances, such as higher living costs or debt obligations.

You can use calculators like nerdwallet and smart asset

FAQs or Relative Questions

Q1 Can the 50-30-20 rule for retirement funds?

Ans Yes Because you can spend 50-70% of your salary on needs. For a retirement fund, you need to create a fund of 30 times your expenses.

Q2 What counts as ‘needs’ in the 50-30-20 rule?

Ans Your needs are those which are very basic things for you like without which you can’t survive like groceries, basic clothing, electricity, etc so these are your needs. And according to this rule, you can spend 50% on it.

Q3 How is this rule for My situation?

- First, make sure you Calculate your net income

- Then Track your spending, especially unwanted ones.

- Also, Set some realistic goals

- Try to Make a plan for

- Adjusting your spending to stay on budget

- Review and check your budget regularly

Q4 Give me Some Budget calculators that can help me.

Ans Here are some Budget calculators

I'm Abhishek, a passionate and creative professional dedicated to making waves in the dynamic world of digital marketing. Today, I'm proud to bring my skills and experience to StofinIQ, where I thrive , delivering impactful content and innovative strategies to inspire and engage audiences.

Post Comment